The Indian Energy Exchange (IEX) achieved a 10% upper circuit on December 3, 2021, when shares traded ex-bonus with a record date of December 6. According to the Money control article, IEX has set December 6, 2021, as the record date for determining the eligibility of shareholders entitled to the issue of bonus equity shares, subject to shareholder approval by postal ballot (including e-voting).

In India, exchanges use the T+2 share delivery method, which is an abbreviation for the trading date plus two days when transactions must be paid. As a result, the shares became ex-date or ex-bonus on December 3rd, just in time for the weekend. In the last six months, IEX stock has risen 125%, compared to a 12% growth in the S&P BSE Sensex, and in the last year, it has risen 273%, compared to a 31% rise in the benchmark index.

About Indian Energy Exchange

The Indian Energy Exchange is the country’s leading energy exchange, offering a state-wide automated trading infrastructure for the actual delivery of power, renewables, and certification. IEX has lately pioneered cross-border energy trade, expanding its power market outside India in an effort to develop an integrated South Asian Power Market. IEX is driven by cutting-edge, user-friendly, and customer-centric systems, allowing efficient pricing discovery and making power procuring easier.

According to the company, IEX has a thriving community comprising 6,800+ participants spread throughout 29 states and 5 union territories, including 55+ distribution utilities and 500+ conventional generators. Since August 2016, the Exchange has had ISO certifications for quality management, security management, and environmental management. It is licenced and supervised by the Central Electricity Regulatory Commission and has been in operation since June 27, 2008. Since October 2017, the Exchange has become a publicly traded business on the NSE and BSE.

Services provided by Indian Energy Exchange

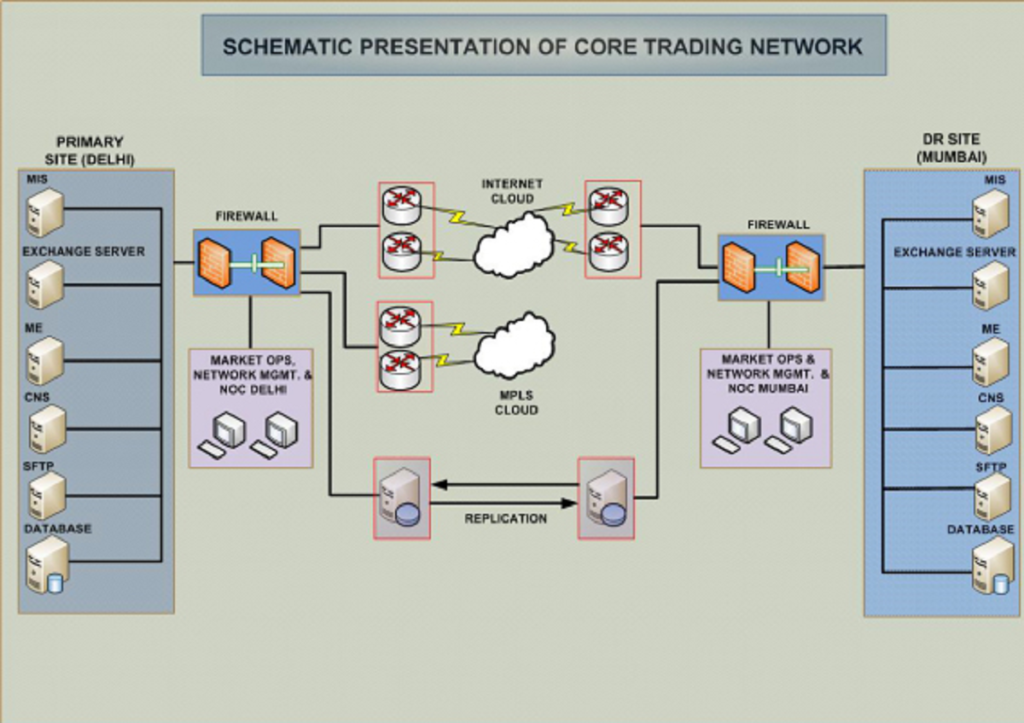

The electronic trading platform at IEX fulfils the essential performance characteristics such as speed, stability, adaptability, security, and volume. Their electronic platform is extremely scalable, allowing everyone to meet expected user growth as demand grows. The integrated package of technologies that they use has been intended to enable a major growth of the present company while also allowing leveraging digital technological base into new markets.

Indian Energy Exchange Trading Application

The Indian Energy Exchange application has a flexible component-based structure that enables unidentified order matching, authentic reference pricing, and profit checking, ensuring price transparency, timely and dependable order routing, exchange disclosure, market information dissemination, and business monitoring. Market players have, in fact, trusted the matching engine on their trading platform in recent years. Aside from efficient and quick valuations, the matching engine attempts to maximise Social Welfare as specified by the CERC Power Market Regulations.

The electronic trading platform is designed and developed in-house by a technological team of IEX that is proven, dependable, and tested technology that contributes to long-term competitive advantage. The Exchange tries to develop innovative goods and services using its technological competence and breadth of knowledge and has proved during the previous ten years of successful operations that its technology platform has the capacity to produce income with increased volumes. The Exchange develops and structures its operations based on its previous experience and anticipated future development.

Will you get bonus shares of Indian Energy Exchange now?

Indian Energy Exchange (IEX) shareholders who buy shares today will not receive bonus shares since the book will close today and the company’s record book shall be updated based on December 2 holdings. The adjustment is being reflected in the NSE’s derivatives segment. The market lot has also increased from 1,250 to 3,750 shares.